By 2026, digital banking in the UK is shaped less by front-end innovation and more by the strength of the foundation underneath. Faster Payments, Open Banking APIs, card schemes, embedded finance, and regulated crypto services all converge at the ledger and orchestration layers. As a result, banks, EMIs, fintechs, and enterprises operating in the UK are prioritising platforms that allow them to evolve products without repeatedly reworking core financial logic.

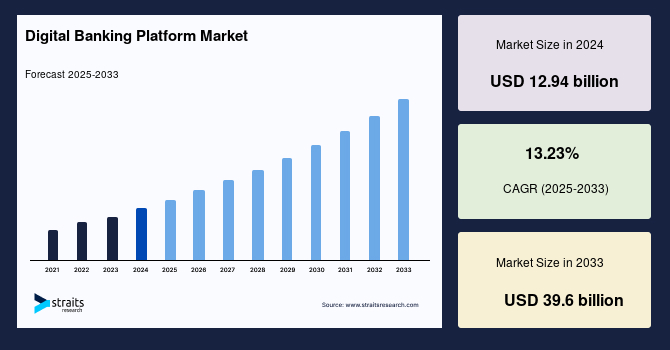

Based on 2025 market data, the global digital banking software market continues to expand and is projected to reach around USD 33 billion by 2030, driven by legacy modernisation and the launch of digital-first financial products. The UK remains one of the most active and competitive markets in Europe, with high digital adoption and a mature regulatory environment influencing platform choices heading into 2026.

Methodology

This ranking reflects a qualitative assessment by industry practitioners based on publicly available information and 2025 market context. It is not an exhaustive list. The focus is on providers that are commonly evaluated in digital banking and payments programmes connected to the UK market, including banks, EMIs, fintechs, and non-financial enterprises entering financial services.

1. SDK.finance

SDK.finance provides a ledger-based white-label banking platform for digital banking and payment products used by banks, fintechs, EMIs, PSPs, and enterprises. The platform combines a real-time transaction ledger, an operational back office, and a broad API layer to support wallets, accounts, payments, card issuing, FX, and accounting.

It also supports crypto on-ramp and off-ramp flows and includes white-label, pre-built mobile and web applications, enabling faster launch of end-user banking and wallet products. With 60+ modules and 470+ APIs, SDK.finance covers a wide range of regulated financial use cases.

Certified under PCI DSS Level 1 and ISO 27001:2022, SDK.finance is designed for environments where security, auditability, and operational control are essential. Flexible deployment options make it suitable for organisations planning long-term platform ownership.

2. Temenos

Temenos is a long-established provider of core and digital banking software used by banks operating in regulated markets. Its platform supports retail, corporate, and wealth banking alongside digital onboarding and servicing.

The system is designed for complex product configurations, multi-currency operations, and regulatory reporting. It is typically adopted by institutions seeking a mature platform with broad functional coverage and a well-established partner ecosystem.

3. Mambu

Mambu is a cloud-native, API-first core banking platform built around composable architecture principles. It allows financial institutions to assemble products from modular components rather than relying on a monolithic core.

It is commonly used for deposits, lending, and payment products. It is often selected where fast time-to-market and partner integration take priority over deep infrastructure-level customisation.

4. Finastra

Finastra offers a broad portfolio covering retail banking, corporate banking, lending, payments, and treasury. Its digital banking solutions support online and mobile channels, while its wider stack enables end-to-end banking operations.

It is often considered where a single vendor approach across multiple banking domains is preferred, particularly in environments shaped by open banking and regulatory change.

5. FIS

FIS provides enterprise-grade core banking, digital banking, and payments technology designed for high transaction volumes. Its platforms integrate digital channels with card processing, fraud management, and compliance systems.

It is typically shortlisted by larger institutions with complex operational requirements and existing multi-vendor technology estates.

6. Fiserv

Fiserv delivers core and digital banking platforms alongside strong capabilities in card issuing and merchant acquiring. Its solutions support deposits, lending, payments, and omnichannel digital experiences.

It is most relevant where payments and card-led propositions are central to the digital banking strategy.

7. Backbase

Backbase focuses on the digital engagement layer rather than the core. It provides mobile apps, online banking portals, onboarding flows, and customer journey management tools.

It is typically deployed to modernise digital channels while retaining existing core banking systems, using it as an orchestration layer across multiple back-end services.

8. Thought Machine

Thought Machine offers a modern core banking platform built around programmable smart contracts. This model allows banks to define product logic in code with a high degree of precision.

It is often evaluated for greenfield banks or full core replacement initiatives where long-term scalability and control over financial logic are key priorities.

9. nCino

nCino provides a cloud-based platform focused on SME and commercial banking workflows, particularly lending. Built around CRM-driven processes, it combines relationship management with credit decisioning and approvals.

It is typically adopted to standardise and digitise SME lending operations, improve turnaround times, and enhance auditability.

10. Oracle FLEXCUBE

Oracle’s FLEXCUBE is a well-established core banking platform covering retail, corporate, investment, and treasury banking.

The system supports multi-country rollouts, multi-currency operations, and compliance with diverse regulatory requirements. It is often adopted when stability, scalability, and integration with a broader enterprise technology ecosystem are the primary decision factors.

Comparison Table: Top Digital Banking Solution Providers in 2026

| Provider | Deployment model | Primary focus and typical use cases |

| SDK.finance | SaaS, source code licence | Ledger-based foundation for digital banking, wallets, payments, card issuing, crypto on-ramp/off-ramp, white-label mobile apps |

| Temenos | SaaS, on-premises | Core and digital banking suite for retail, corporate, and wealth banking |

| Mambu | SaaS (cloud-native) | Composable core banking for digital banks, savings, lending, and payment products |

| Finastra | SaaS, on-premises | Broad banking software portfolio across retail, corporate, lending, payments, and treasury |

| FIS | SaaS, managed services, on-premises | Enterprise-grade core banking, digital channels, and payments at scale |

| Fiserv | SaaS, on-premises | Core banking, digital banking, card issuing, and merchant acquiring |

| Backbase | SaaS, on-premises | Digital engagement and orchestration layer for mobile and online banking |

| Thought Machine | SaaS, cloud-native | Modern core banking platform for greenfield banks and core replacement |

| nCino | SaaS | SME and commercial lending workflows built around CRM-driven processes |

| Oracle FLEXCUBE | SaaS, on-premises | Mature core banking system for complex, multi-product banking operations |

Final thoughts

Digital banking in the UK entering 2026 increasingly relies on layered architectures built around a reliable ledger and transaction foundation, supported by flexible digital orchestration and specialised platforms where required.

Within this landscape, SDK.finance stands out for organisations seeking a balance between speed of launch and long-term control. Its ledger-based foundation, crypto on-ramp and off-ramp support, white-label mobile applications, and flexible deployment models closely match how modern digital banking products are being designed and operated today.