Many traders lose money not because their strategy is flawed, but because their account setup doesn’t match their trading behavior. This is one of the least discussed issues in broker comparisons, and it’s where Pocket Option’s account structure deserves closer inspection.

Most competitor reviews list features without explaining real-world implications.

Why Account Fit Matters More Than Strategy

Your account type directly affects:

- Execution conditions

- Psychological pressure

- Access to analytical tools

Using the wrong account can quietly sabotage even a solid strategy.

Hidden Problems Traders Encounter

Competitor platforms often:

- Push upgrades without explaining trade-offs

- Restrict features behind unnecessary tiers

- Fail to disclose how account limits impact withdrawals

This leads traders to scale prematurely or overtrade to “justify” higher-tier access.

How Pocket Option Approaches Account Design

Pocket Option structures its account tiers to align with trader maturity, not just deposit size. Instead of forcing early upgrades, it allows traders to grow into advanced features logically.

A clear breakdown of these account types and their real use cases is available here: Pocket Option account types explained

Choosing the Right Account for Your Style

Developing Traders

Best served by:

- Lower minimum deposits

- Strong demo-to-live transition tools

- Transparent withdrawal rules

Systematic Traders

Benefit from:

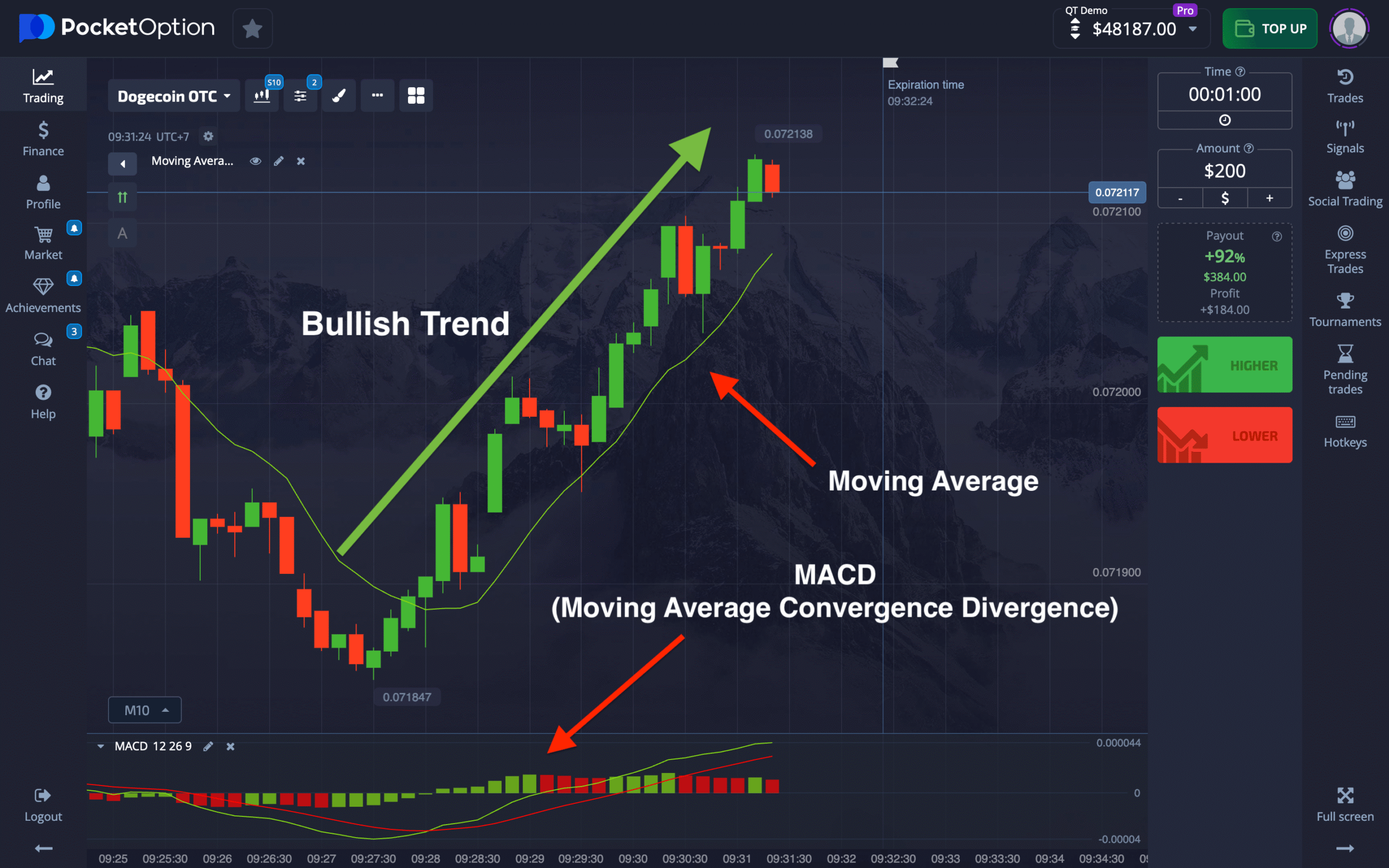

- Analytical dashboards

- Performance metrics

- Risk tracking overlays

Advanced Traders

Require:

- Fast execution

- Priority support

- Advanced strategy tools

Competitor Gaps Addressed

Most reviews ignore:

- Behavioral impact of account pressure

- Tool overload at early stages

- Withdrawal friction across tiers

Choosing an account should reduce stress, not increase it.